maine excise tax rates

The excise tax you pay goes to the construction and. Excise Tax is calculated by multiplying the.

The Great Tax Divide Maine S Retail Desert Vs New Hampshire S Retail Oasis Maine Policy Institute

13 rows Maine Tax Portal.

. The federal gasoline excise tax is a tax that was implemented to fund transportation-related projects. Definition And Example Of The Federal Gasoline Excise Tax Rate. Departments Treasury Motor Vehicles Excise Tax Calculator.

Beginning April 1 1984 upon payment of the excise tax the municipality shall certify on forms provided by the Department of Inland Fisheries and Wildlife. The Commercial Forestry Excise Tax CFET is imposed on owners of more than 500 acres of commercial forest land. How much will it cost to renew my.

July 1 - June 30. 16 rows Effective July 1 2009 the full diesel excise tax rate is imposed on biodiesel fuels that contain less than 90 biodiesel fuel by volume. YEAR 1 0240 mil rate YEAR 2.

A registration fee of 3500 and an agent fee of 600 for new vehicles will also be charged for a total of 64180 due to register your new vehicle. This calculator is for the renewal registrations of passenger vehicles only. Office of Cannabis Policy 162 State House Station Augusta ME 04333.

The 2022 state personal income tax brackets are. Mil rate is the rate used to calculate excise tax. Share this Page How much will it cost to renew my registration.

Enter your vehicle cost. As of August 2014 mil rates are as follows. Commercial Forestry Excise Tax.

4 The fuel excise tax rates in effect on July 1. The rates drop back on January 1st each year. July 1 - June 30.

Our office is also staffed to administer and oversee the property tax administration in the unorganized territory. The rates drop back on January 1st each year. Contact 207283-3303 with any questions regarding the excise tax calculator.

Title 36 1504 Excise tax. For questions about your tax bill please contact the Division of Collection and Treasury. - NO COMMA For.

Tax Rate Per 1000 2000 mils. Excise Tax is calculated by multiplying the MSRP by the mil rate as shown below. Visit the Maine Revenue Service page for updated mil rates.

The rates drop back on January 1st each year. 2721 - 2726. Property Tax Stabilization Program.

Welcome to Maine FastFile. Mil rate is the rate used to calculate excise tax. Excise Tax is calculated by multiplying the MSRP by the mil rate as shown to the right.

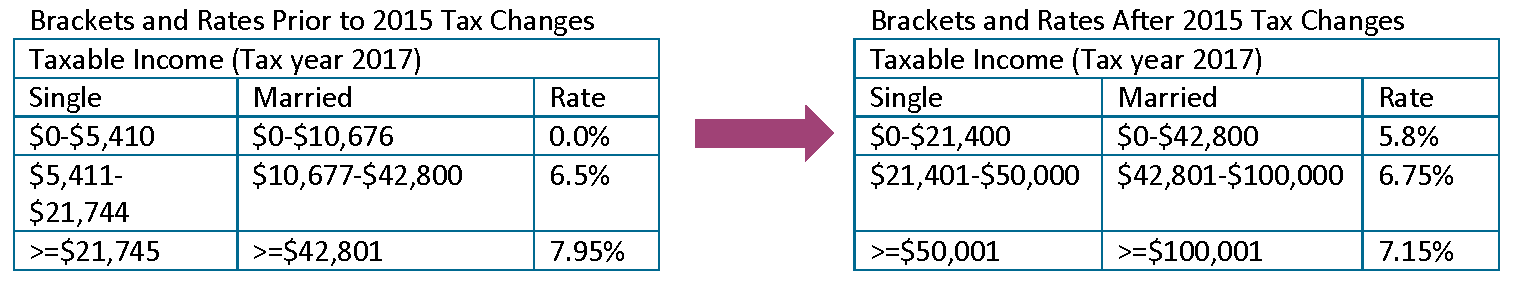

Before the official 2022 Maine income tax rates are released provisional 2022 tax rates are based on Maines 2021 income tax brackets. Excise Tax Calculator This calculator will allow you to estimate the amount of excise tax you will pay on your vehicle. Designed to provide the public with answers to some of the.

To calculate your estimated registration. The excise tax due will be 61080. Maines Office of the Revisor of Statues explains that youll pay 5 per year in excise tax if you own a motor vehicle.

22500 X 0100 225.

Us Maine Withdraws Sales Tax Transaction Threshold For Foreign Sellers Vatcalc Com

How Maine S Personal Income Taxes Work Mecep

Federal Excise Tax Rates Extended Through 2020

Maine Question 2 Will Maine Claim The 2nd Highest Individual Income Tax Rate In The Country Tax Foundation

Maine Income Tax Calculator Smartasset

Motor Vehicle Registration Scarborough Town Of

Biddeford Man Wants To Change Maine Excise Tax With Citizen Initiative On Ballot Wgme

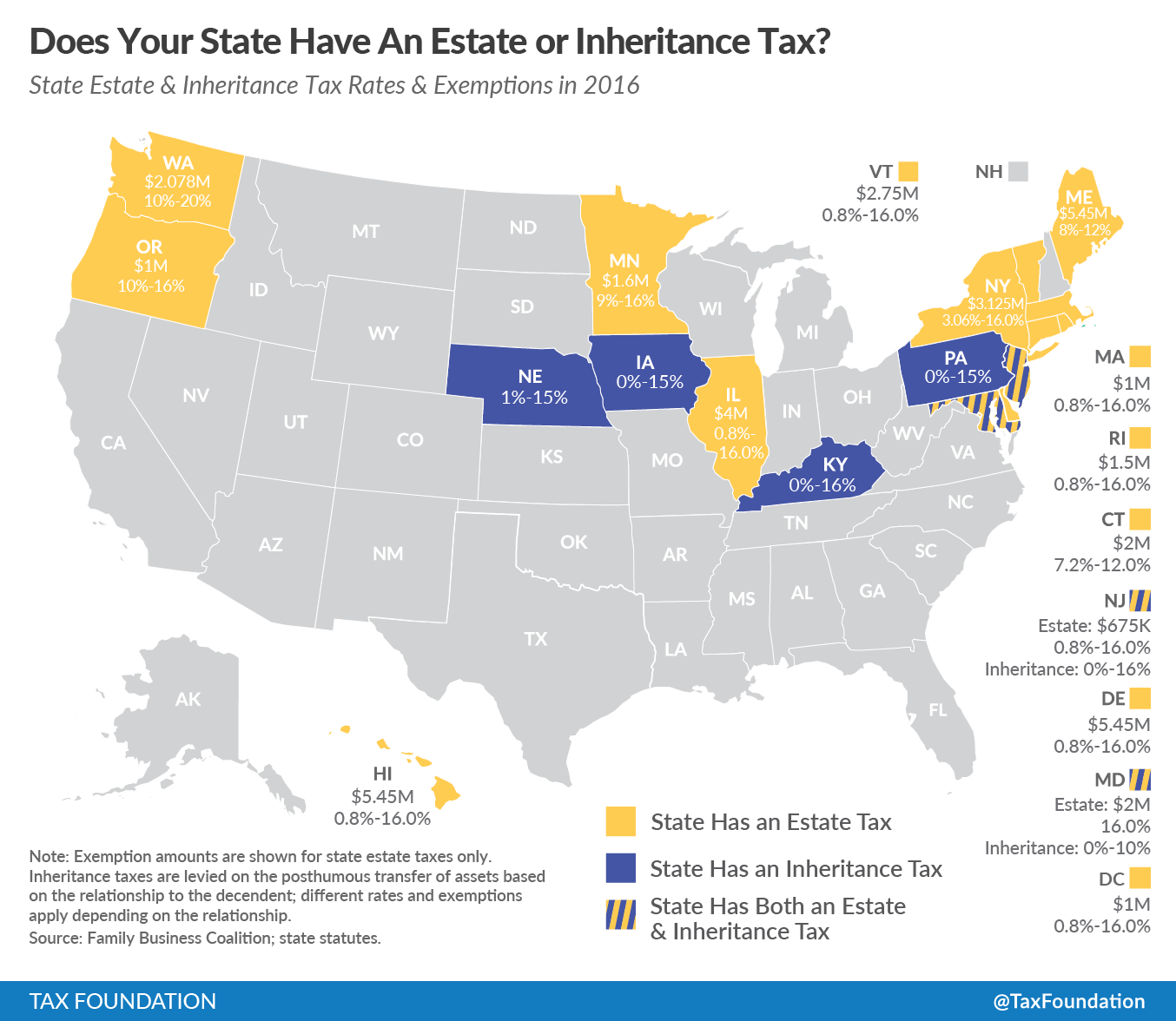

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Car Tax By State Usa Manual Car Sales Tax Calculator

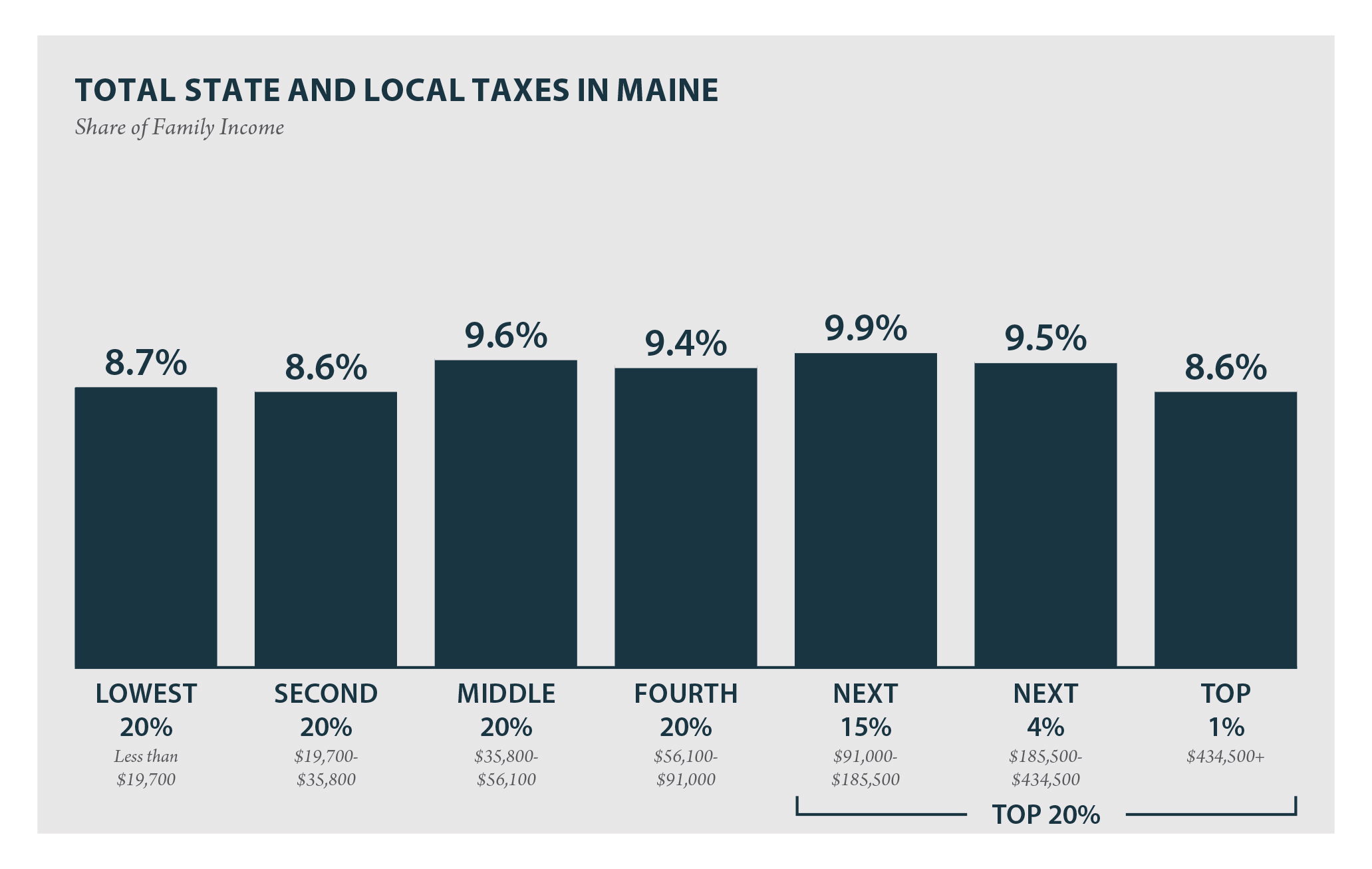

State Tax Levels And Tax Progressivity Lane Kenworthy

The Great Tax Divide Maine S Retail Desert Vs New Hampshire S Retail Oasis Maine Policy Institute

Maine Who Pays 6th Edition Itep

Maine Alcohol Sales Went Flat After Boom Early In The Pandemic Portland Press Herald

Maine Alcohol Taxes Liquor Wine And Beer Taxes For 2022

Maine Governor Lepage Proposes Good Tax Policy In New Budget Tax Foundation

Maine Cigarette And Tobacco Taxes For 2022

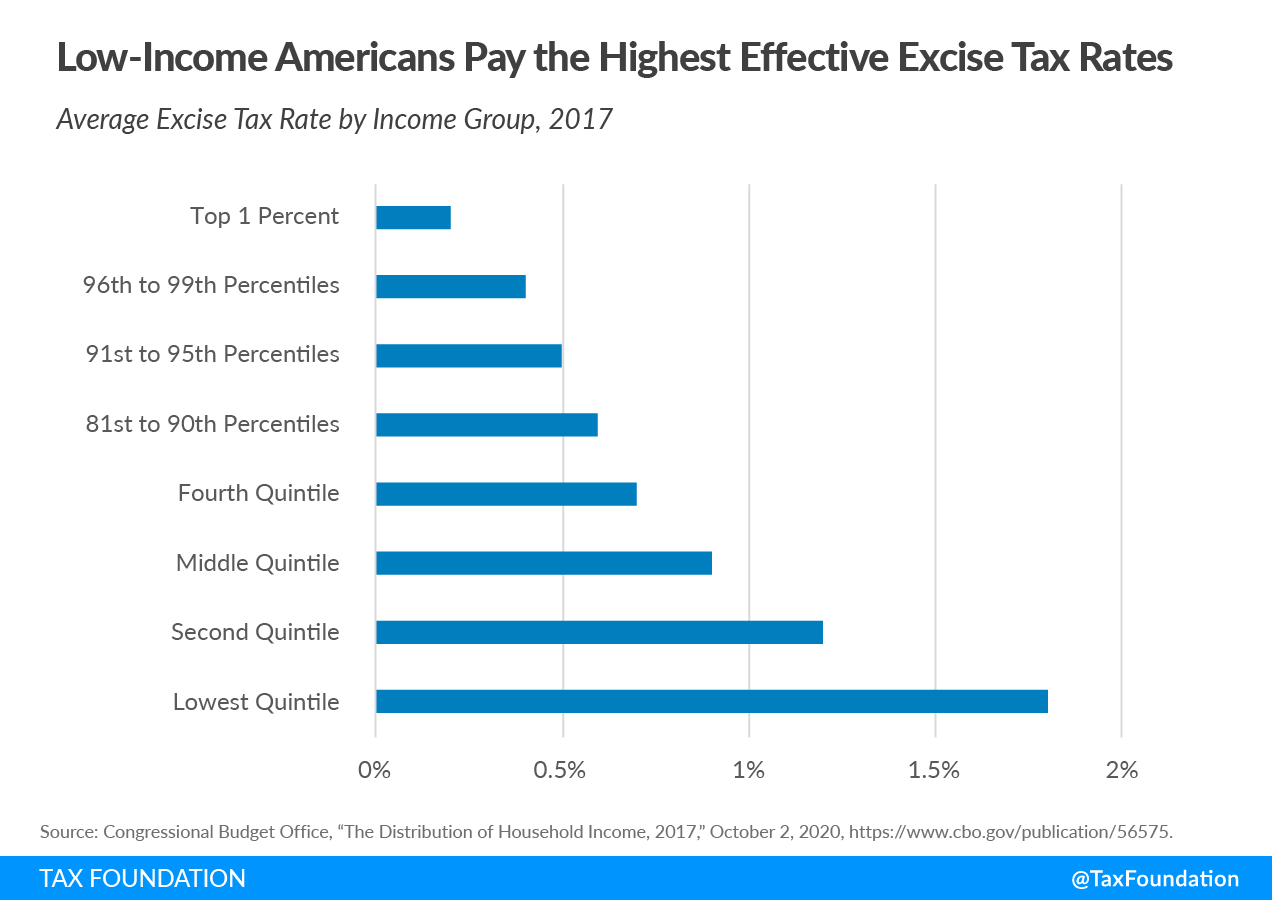

Excise Taxes Excise Tax Trends Tax Foundation

Want To Lower Maine S Tax Burden Don T Forget To Consider Raising Incomes